Here’s what on-chain data says about which cryptocurrency exchanges are currently the platforms of choice for Bitcoin whales.

Bitcoin Exchanges Ranked Based on Whale Ratio

In a new post on X, CryptoQuant community manager Maartunn discusses which exchange is currently number one in Bitcoin Exchange Whale Ratio.

“Exchange Whale Ratio” here refers to an indicator that tracks the ratio between the sum of the top 10 exchange inflows and the total exchange inflows for a particular platform.

The ten largest inflows to exchanges are generally thought to come from whale entities, so the value of this metric tells us what share of the platform’s total inflows was generated by these large investors.

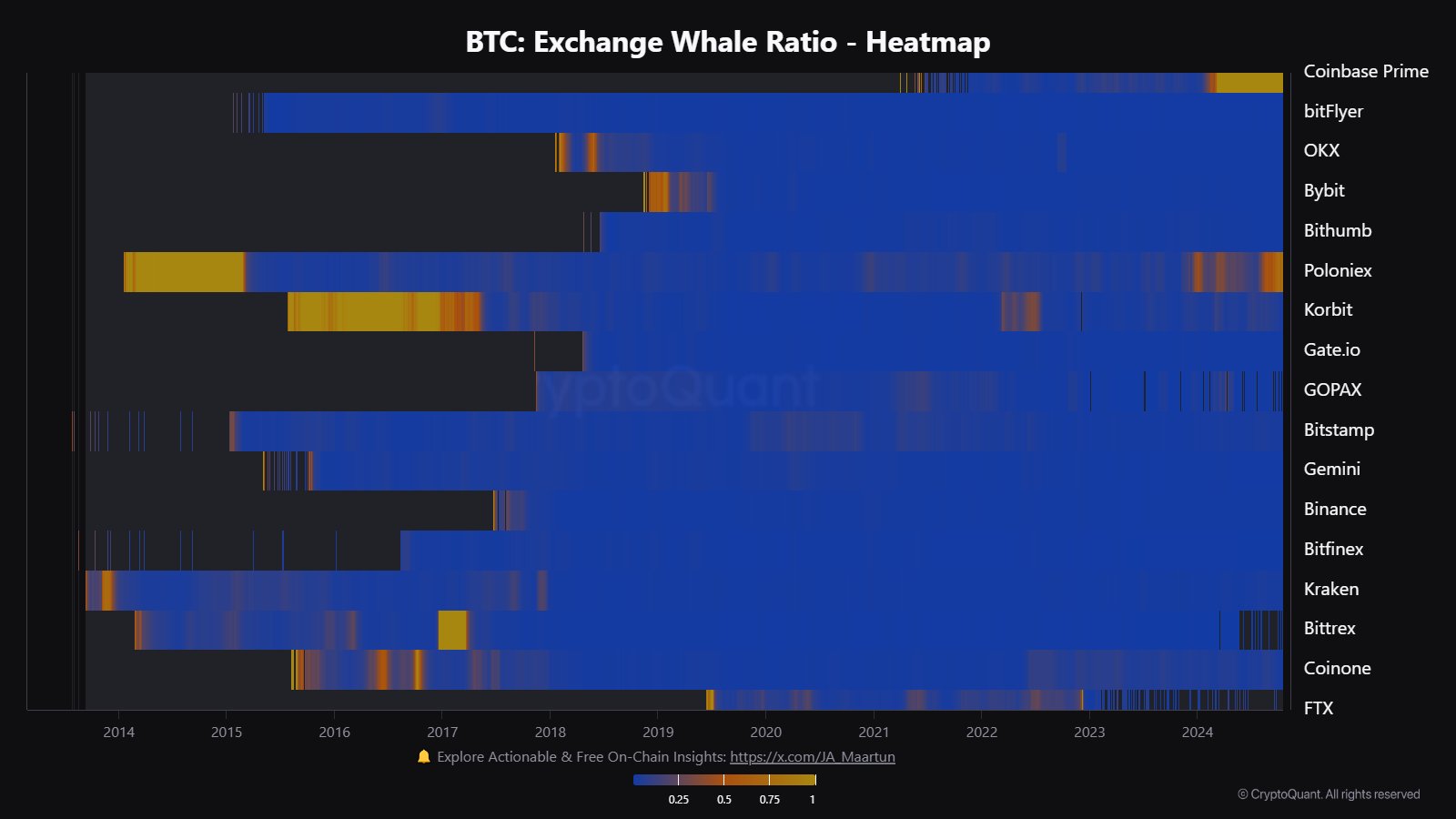

Now, here is a chart shared by Maartunn that shows how the Bitcoin Exchange Whale Ratio has changed for various exchanges in the sector over the last decade:

Looks like Coinbase currently has this metric at the highest value | Source: @JA_Maartun on X

On the graph, blue corresponds to Bitcoin Exchange Whale Ratio values close to 0, red to values around 0.5, and yellow to values close to 1. It seems that while most exchanges have blue, Coinbase stands out because it has a yellow line that consistent for a while now.

This shows that whales make almost all BTC inflows go to Coinbase. In contrast, other exchanges experienced a predominance of retail exchange inflows, including Binance, the largest cryptocurrency platform in terms of trading volume.

The graph shows that while Coinbase dominated whale activity this year, that wasn’t always the case. The platform’s growth as a home for whales can be attributed to one event: the launch of a spot exchange-traded fund (ETF).

Spot ETFs finally received approval from the US Securities & Exchange Commission (SEC) earlier this year. Since then, this new financial instrument has become increasingly popular among investors.

Spot ETFs allow investors to gain indirect exposure to BTC price movements, meaning they do not need to own the original BTC token; where ETFs buy and hold coins on behalf of their users.

Now, spot ETFs have to store these BTC safely, and for this purpose, most of them have chosen Coinbase as their custodian. The unique position that these platforms have gained in the sector may explain why the platform’s inflow has been so large this year.

BTC Price

Bitcoin had suffered a setback below the $67,000 level earlier in the day, but it appears the asset has recovered as its price is now trading around $67,200.

The price of the coin seems to have been enjoying bullish momentum recently | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com