This article is also available in Spanish.

On-chain data shows Bitcoin whale transactions have surged following the latest rally, a sign that profit-taking may have begun.

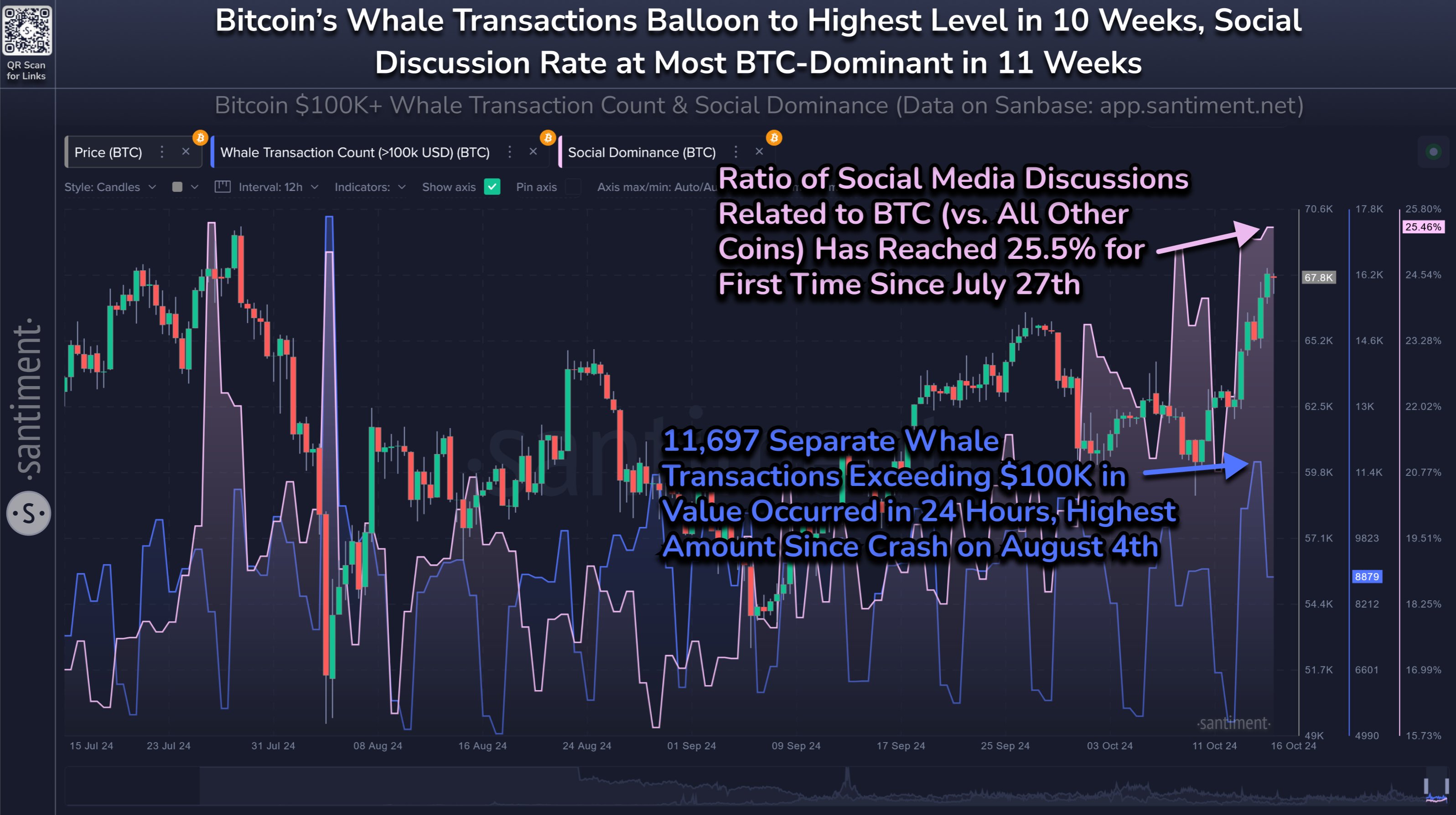

Number of Bitcoin Whale Transactions Now Highest In Over 10 Weeks

According to data from on-chain analytics firm Santiment, Bitcoin whales have shown increased activity recently. The relevance indicator here is the “Whale Transaction Count,” which tracks the total number of transfers taking place on the BTC blockchain that are worth at least $100,000.

If the value of this metric is high, it means that whales are making a lot of movement in the network at the moment. Such a trend implies that a large number of coin holders have an active interest in trading the coin.

Related Reading

On the other hand, the low indicator suggests that whales may not currently pay much attention to cryptocurrencies because they do not carry out too many transactions.

Here is a graph showing the Bitcoin Whale Transaction Number trend over the past few months:

As shown in the graph above, the Number of Bitcoin Whale Transactions has seen a significant spike recently, indicating that whales have been making large transfers. More specifically, this giant entity made a total of 11,697 transfers in a 24-hour period at the peak of this surge.

In general, it is difficult to say anything about the type of transfer activity that whales participate in based on the Number of Whale Transactions alone, because buying and selling transactions look the same from an indicator point of view. However, the accompanying price movement may provide some clues.

The latest peak in this metric is the highest the indicator has reached since early August. At that time, the surge coincided with a fall in asset prices, implying that most of the whales’ movements were probably aimed at selling.

The current increase in the number of whale transactions occurs in line with the strength of Bitcoin, so there is a possibility that whales will participate in profit-taking again. Since the spike occurred, BTC has fallen below $67,000, which may add to the evidence of this.

In the same graph, Santiment also attached data for another BTC metric: Social Dominance. This indicator basically tells us about the share of social media discussions that Bitcoin occupies compared to the total of the top 100 assets in the sector.

From the graph it can be seen that Social Dominance has jumped up to 25.5% for the cryptocurrency, which is the highest value since the end of July. Thus, Bitcoin’s mindshare is currently high when compared to altcoins.

Related Reading

This is usually a signfear of missing out (FOMO) amongtrader. Historically, excessive hype is a bad sign for BTC, and is often followed by tops.

“Both of these signals are signs that the rally may be stalling due to profit-taking by key stakeholders and high levels of mass FOMO,” the analytics firm noted.

BTC Price

At the time of writing, Bitcoin is trading at around $66,900, up more than 9% over the past week.

Featured images from Dall-E, Santiment.net, charts from TradingView.com